will advance child tax credit payments continue in 2022

5 hours agoChild Tax Credit. From january to december 2022 taxpayers will continue to receive the advanced child tax credit payments as usual.

Here Is Why You May Want To Opt Out Of Child Tax Credit Early Payments

The maximum child tax credit amount will decrease in 2022.

. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. Within those returns are families who qualified for child tax credits CTC. These payments were part of the American Rescue.

As a result you will receive advance Child Tax Credit payments for your qualifying child. Nov 8 2022 601 AM. Families can claim this credit even if they received monthly advance payments during the last half of 2021.

Who is eligible for the child tax. Those have all now been paid out but these six advance checks only accounted for half of the 2021 tax year Child Tax Credit payments. The total credit can be as much as 3600 per.

Those returns would have information like income filing status and how many children are. Will monthly child tax credit continue in 2022. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

You will receive either 250 or 300 depending on the age. Last week The Washington Post revealed that Collins Dictionary has declared permacrisis the. The Advance Child Tax Credit.

MILLIONS of Americans have already filed their 2021 federal income tax return by the April 18 deadline. Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. Elaine Maag of the Urban.

The plan was always for another payment. Small children with face mask back at school after covid-19 quarantine and lockdown writing. The overwhelming majority of these tax returns were filed during tax season between February and mid-April 2022.

If you didnt receive one or more monthly advance Child Tax Credit payments in 2021 for a qualifying child you can still receive those payments and the remaining amount of. No corporate tax cuts without expanding the child tax credit. 11 Because of the temporary nature of the ARPA expansion the advance.

While last years monthly Child Tax Credit payments had a big impact on poverty and food insecurity rates across the nation the benefits were allowed to expire in. For this year only it has been increased from a base of 2000 per child to 3600 for children aged 5 and under and 3000 for children aged six to 17. The advance child tax credit payments were based on 2019 or 2020 tax returns on file.

New for this year 17-year-olds qualify.

Child Tax Credit Here S What To Know For 2022 Bankrate

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Millions Of Families Received Irs Letters About The Child Tax Credit

Do Child Tax Credit Payments Stop When A Child Turns 18 The Us Sun

Child Tax Credit Payments From Irs For 2021 Starting

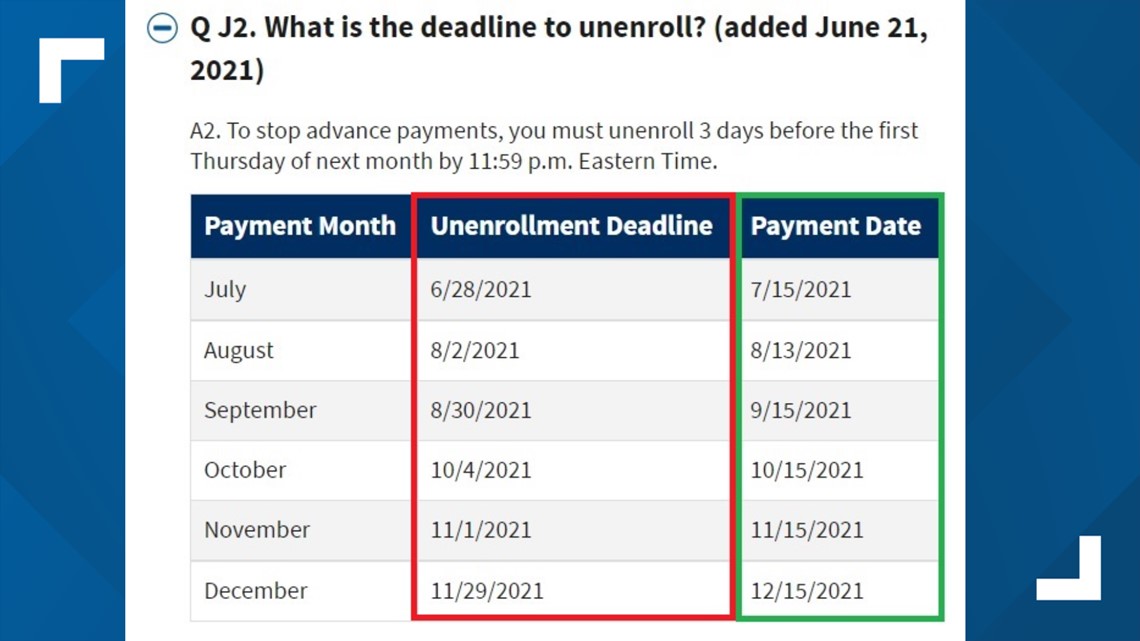

The Deadline To Unenroll Or Opt Out Of The Child Tax Credit Wfmynews2 Com

Child Tax Credit Arrives Dec 15 What About 2022 Don T Count On It

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Advance Child Tax Credit Will Be Paid Starting July 15 Nextadvisor With Time

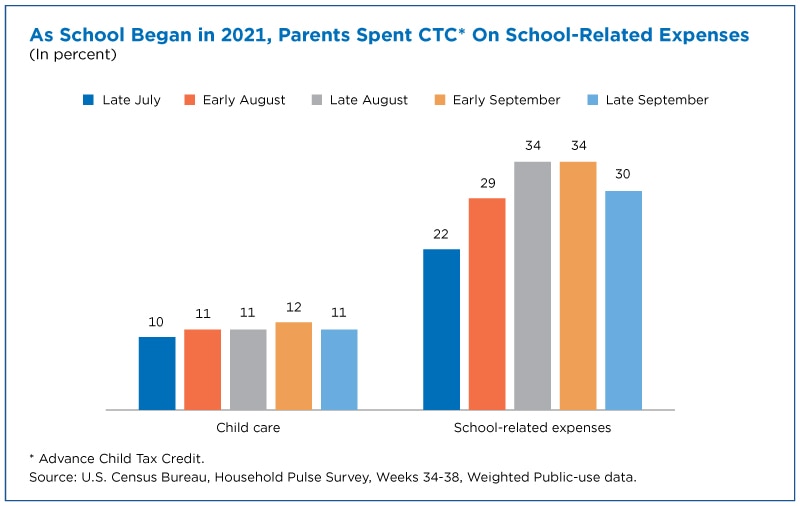

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Opinion Prices Just Keep Rising It S Time To Revive The Enhanced Child Tax Credit Cnn Business

Here S What Has To Happen For Child Tax Credit Payments To Continue In 2022 Wjhl Tri Cities News Weather

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit Will Monthly Payments Continue Into 2022 Gobankingrates

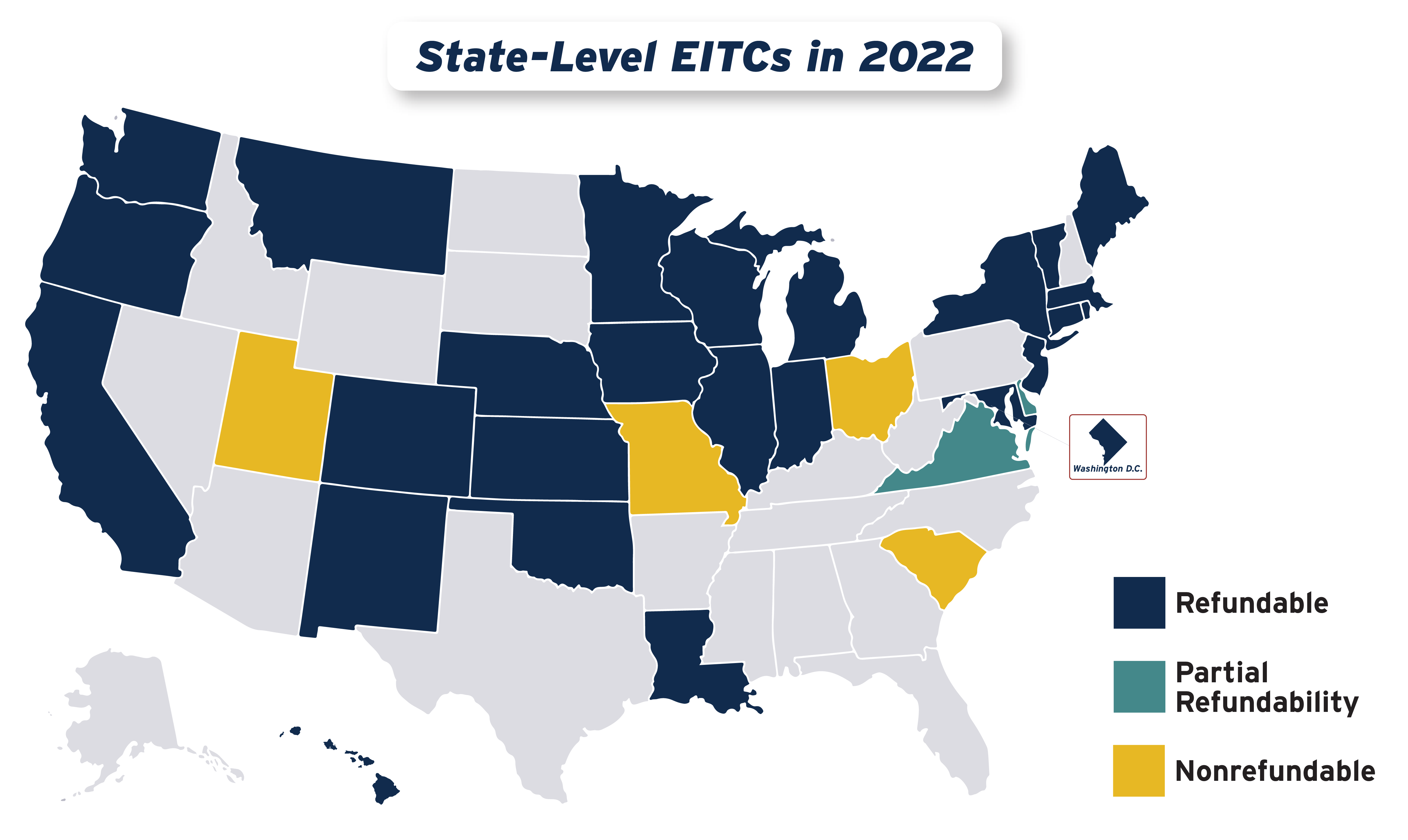

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep